Modifying Item Tax Properties

The POS application enables retailers to modify the tax properties of an item or of an entire transaction.

Configurable features

The POS application can be configured with the following features.

- Enable item-level and transaction-level tax override option.

- Tax Override Setup > Manual Tax Override

- Make an item is taxable or non-taxable.

- Tax Override Setup > Manual Item Taxability

- Specify the maximum tax percentage that can be applied to an item or an entire transaction.

- Tax Override Setup > Tax Override Maximum Percent

- Specify the character that will be printed on receipts to indicate that a tax override was applied.

- Tax Override Setup > Tax Override Tax Character

- Add and modify tax override reason options. Refer to the following options:

- Tax Override Reason Code > Sequence Number

- Tax Override Reason Code > Tax Override Reason Code

- Tax Override Reason Code > Tax Override Reason Description

Minimum and maximum tax thresholds

The POS application permits retailers to set a minimum or maximum taxable amount for specific items. For tax minimums, the item price below or equal to the minimum limit does not get taxed. For tax maximums, the item amount that exceeds the maximum limit does not get taxed. Retailers may also specify both a minimum and maximum threshold for an item.

To specify the minimum and maximum tax thresholds, configure the tax rules in the Product Catalog using the TaxRules API. For more information, consult with an NCR Representative.

Sample scenarios for minimum and maximum tax thresholds

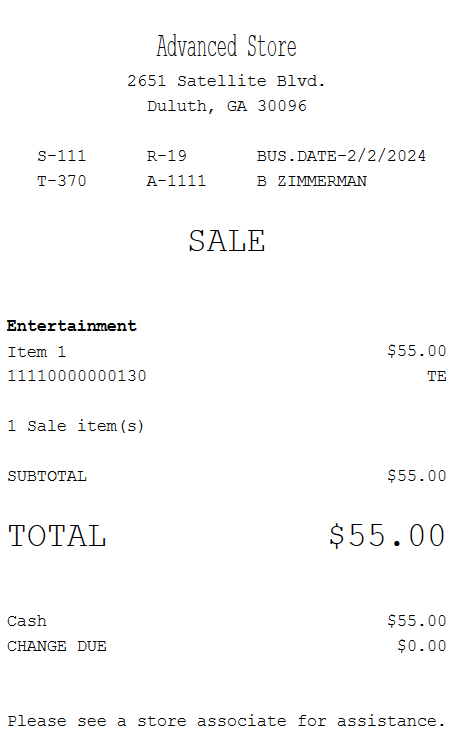

If the item price is below or equal to the minimum threshold but below the maximum threshold, no tax is applied to the item.

ExampleIf the item price is $55, minimum threshold is $60, and maximum threshold is $75, no tax is applied to the item.

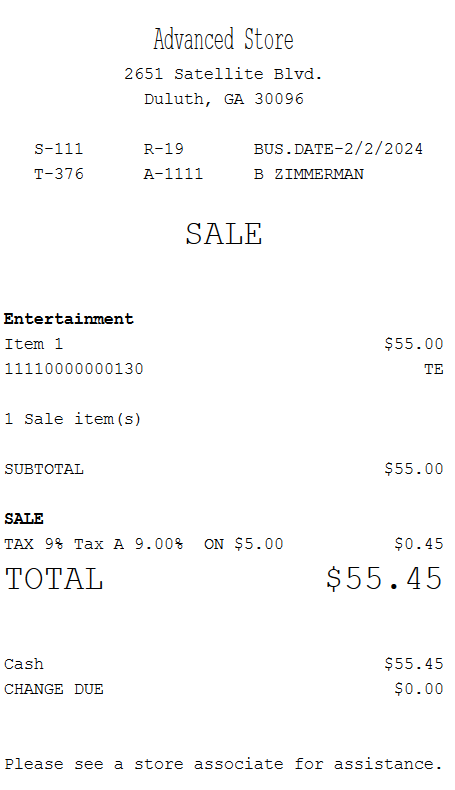

If the item price exceeds the minimum threshold but is below the maximum threshold, tax is applied only to the amount that exceeds the minimum threshold.

ExampleIf the item price is $55, minimum threshold is $50, and maximum threshold is $75, tax is applied only to the $5 that exceeds the minimum threshold.

If the item price exceeds the minimum threshold but is equal to the maximum threshold, tax is applied only to the amount that exceeds the minimum threshold.

ExampleIf the item price is $55, minimum threshold is $40, and maximum threshold is $55, tax is applied only to the $15 that exceeds the minimum threshold.

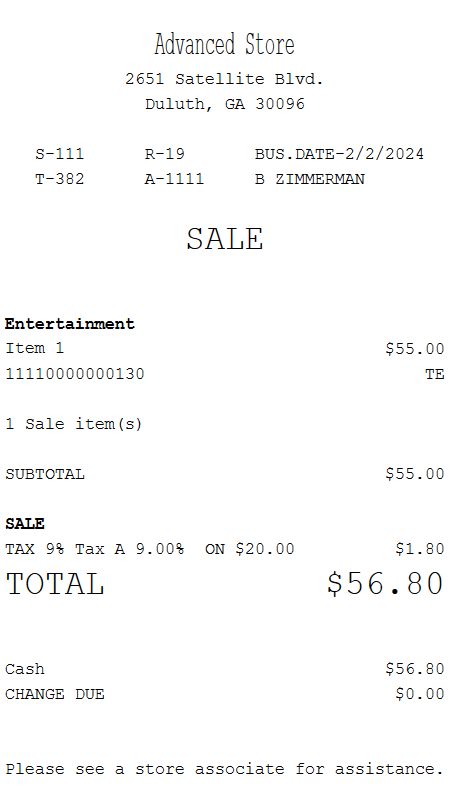

If the item price exceeds the minimum and the maximum thresholds, the amount that exceeds the minimum threshold is compared against the maximum threshold. If the amount that exceeds the minimum threshold is less than the maximum threshold, tax is applied only to that excess amount.

ExampleIf the item price is $55, minimum threshold is $35, and maximum threshold is $50, tax is applied only to the $20 that exceeds the minimum threshold.

If the item price exceeds the minimum and the maximum threshold, the system compares the amount that exceeds the minimum threshold to the maximum threshold. If the amount that exceeds the minimum threshold is more than the maximum threshold, tax is applied only to the maximum threshold amount. Any amount that exceeds the maximum threshold is not taxed.

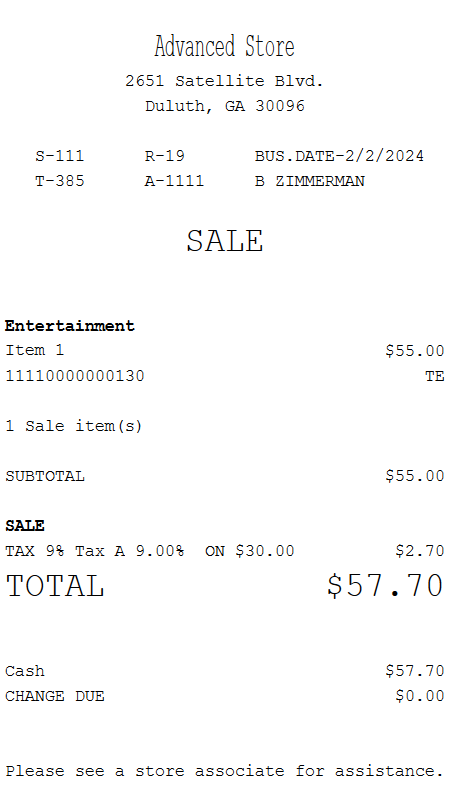

ExampleIf the item price is $55, minimum threshold is $20, and maximum threshold is $30. There is an excess of $35 from the minimum limit; however, only $30, which is the maximum threshold, is taxed.