Accepting Charity Donations

The POS application accepts donations to the customer’s chosen charity during a sales or exchange transaction. The charity donation is considered as a non-taxable item and is added in the receipt along with other items.

Configurable features

The POS application can be configured with the following features.

- Enable the charity donations feature. Refer to the following option:

- Charity Donation > Enable Charity Donation

- Specify a time frame to display the Charity Donation screens. Refer to the following options:

- Charity Donation > Charity Start Date

- Charity Donation > Charity End Date

- Predefine donation amounts on the Charity Donation screen. Refer to the following option:

- Charity Donation > Default Amounts for Donation

- Specify a list of charities on the List of Charities screen. The buttons can be configured to display the name of the charities. Refer to the following option group:

- Charities List > Sequence Number

- Select the transaction types where the List of Charities and the Charity Donation screens are not displayed on the POS application and the PIN pad. Refer to the following option:

- Charity Donation > Restrict Donation For TransactionType

- Specify the incremental amount by which the transaction total is rounded up to determine the charity donation amount. This amount is applied when the Round Up button is selected on the POS application or the PIN pad. The text on the Round Up button can be configured using configurable text files. Refer to the following sections:

- Charity Donation > Charity Roundup Button Amount

- POS user interface configurable text

ExampleIf the total is $21.94 post-tax and the Charity Round Up Button Amount value is set to 100 ($1.00), selecting the Round Up button adds a charity donation of $0.06, bringing the total to the next dollar amount of $22.00.

NoteUsing this feature on a PIN pad requires additional retailer integration and retailer-specific screens. For more information, consult with an NCR Representative.

- Require authorization when the associate skips charity donations during a sales or exchange transaction. Refer to the following option:

- Authorization Overrides > Authorization Functions > CharitySkipButton

- Specify short names for the charity organizations and the Round Up amount text that are displayed on the PIN pad buttons. Configure the short name for the Round Up amount text using configurable text files. Refer to the following options:

- Charities List > Sequence Number > all records. Specify the Charity Short Name.

- POS user interface configurable text

- Restrict charity donations during exchange transactions when the balance is negative or zero. Refer to the following options:

- Validation Definitions > Validation Scheme ID > CharityPromptingThreshold

NoteRetailers can refer to the sample data table.

To accept charity donations, follow these steps:

- Perform a sales or exchange transaction. For more information, refer to Making a sale or Exchanging Items for Return.

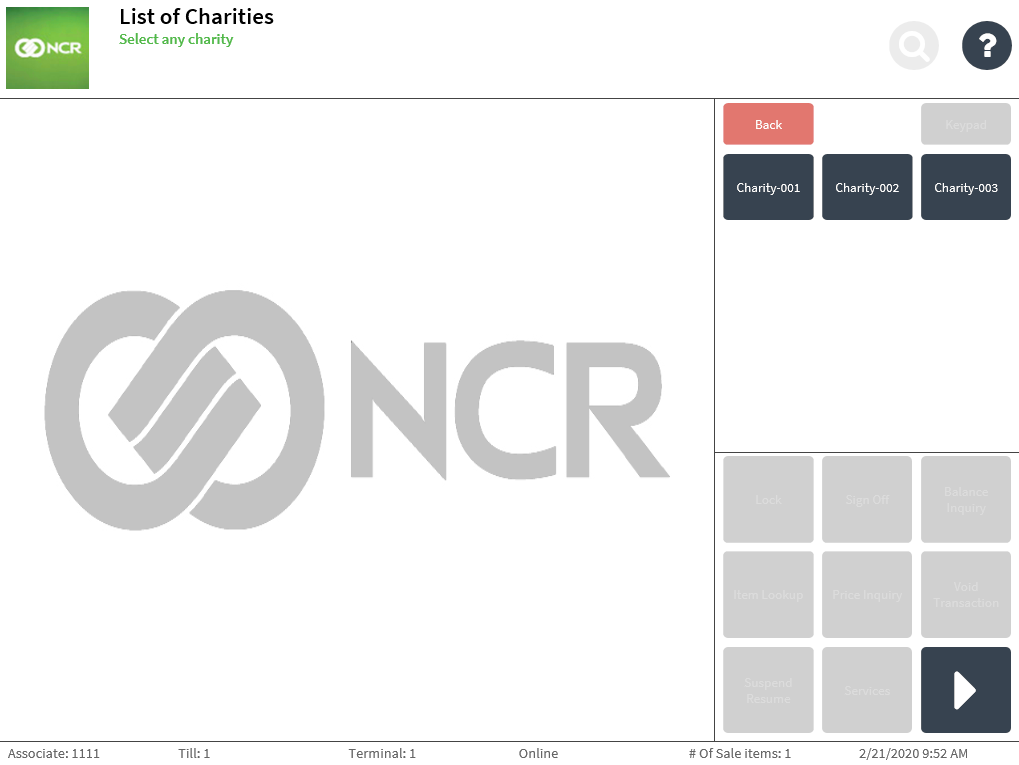

- After scanning or keying in an item for sale or exchange, select Pay. The POS application and the PIN pad displays the List of Charities screen.

Note

Note- If only one charity is added to the system, the POS application and PIN pad does not display the List of Charities screen.

- If a transaction occurs outside the configured time frame for the charity donations function, the POS application and the PIN pad does not display the List of Charities and the Charity Donation screens and proceeds to the Tender Menu screen.

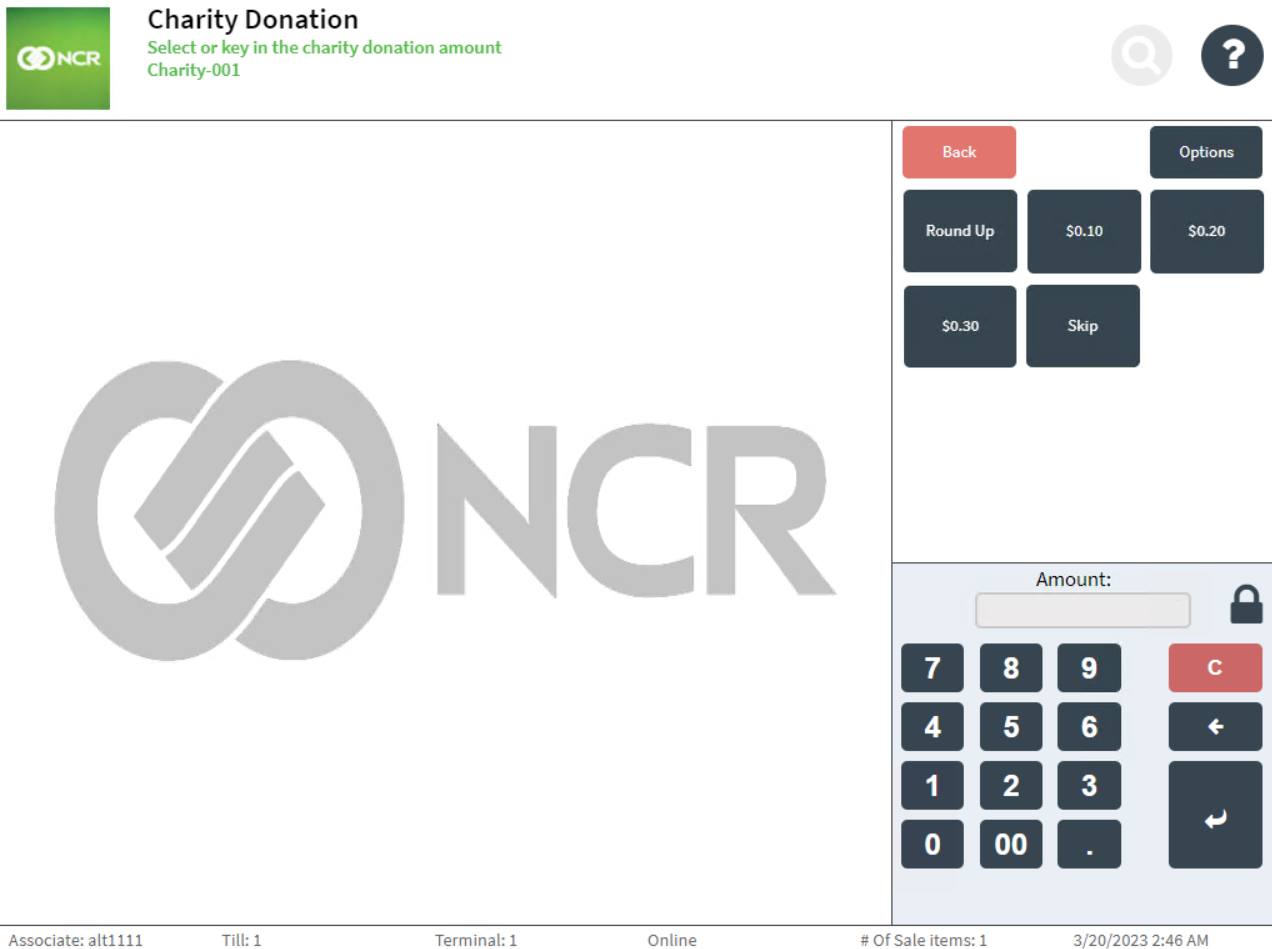

- Select a charity. The POS application and the PIN pad displays the Charity Donation screen.

- Do one of the following or instruct the customer to do one of the following on the PIN pad:

- Select a suggested donation amount.

- Enter the amount on the keypad, and then select Enter.

- If enabled, select the Round Up button for the system to determine the charity donation amount based on the specified Charity Roundup Button Amount parameter value.

- Skip accepting a charity donation from the customer. Note

If an associate is not authorized to skip charity donations, an authorized associate must approve it.

The application displays the Tender Menu screen.

- Complete the transaction. The application prints the receipts.

- Close the cash drawer.

Sample receipt

The amount donated to charities is printed on the Sale receipt.